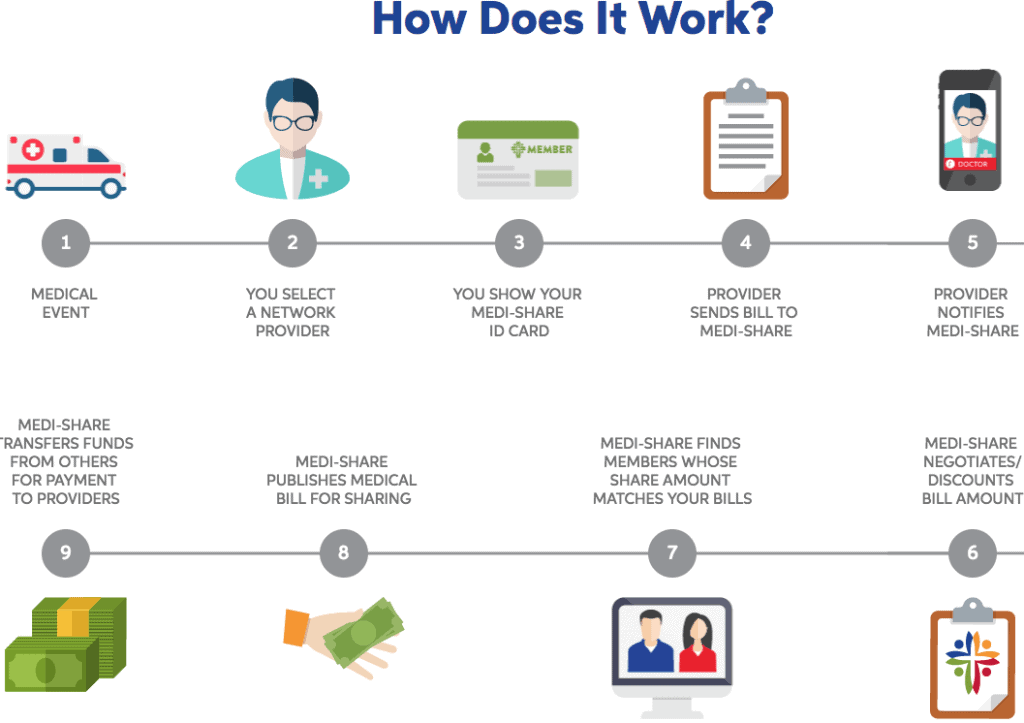

Those sharing through HCSMs are called members and the money sent by members to other members to help pay for their medical expenses is called a share. Your Annual Household Portion is similar to a deductible.

What To Do During Tax Time Christian Healthcare Ministries

You can view the Christian Care Ministry.

Christian healthcare ministries tax deductible. Under the proposed IRS regulation payments for membership in a health care sharing ministry that. For tax year 2020 you do not need to fill out any specific federal tax forms indicating that as a member of a health care sharing ministry you are exempt from the ACA mandate to have insurance. Furthermore at the federal level you are not required to claim an exemption provide documentation of your membership make a.

Though CHM is a 501 c3 nonprofit organization because you receive the service of healthcare sharing membership amounts cannot be claimed as donations. Unlike traditional health insurance members of healthcare sharing ministries such as Medi-Share are exempt from the individual mandate penalty that has been imposed on those who can afford to purchase health insurance but opt out. While not considered insurance sharing ministries have a special exemption.

Only extra giving including Prayer Page donations is considered tax-deductible. The Service should be issuing its final regulation on the health care sharing tax deduction in the coming monthslikely before the 2020 election. However all extra giving over and above your minimum monthly gift to Christian Healthcare Ministries including Prayer Page giving qualifies as a charitable contribution for tax purposes.

Except in Missouri monthly financial gifts to CHM are not tax-deductible. Only extra giving including Prayer Page donations is considered tax-deductible. IRC 213 allows taxpayers to take an itemized deduction for expenses for medical care including insurance for medical care to the extent the expenses exceed 75 of adjusted gross income.

CHM mails a tax statement to all Missouri members but only to members from other states who in 2018 contributed extra giving. Christian Healthcare Ministries CHM is an budget-friendly biblical and compassionate healthcare cost solution for Christians in all 50 states and around the world. But they qualify for an exemption under the ACA so individuals on the programs are not penalized for having non qualified health coverage.

There are several Annual Household Portions for you to choose from ranging from 500 to 10000. Is exempt from federal income tax under Section 501c3 of the Internal Revenue Code. The tax penalty was not reduced to zero until Jan.

Deduction of Share Portions. 1 2019 and thus will not affect your 2018 income tax filing. Medi-Share is not insurance and Medi-Share members CANNOT deduct their monthly share portions from their federal income tax unless you are a resident of Missouri where you can deduct share amounts from your State income taxes.

This is the amount that have to pay before your bill is eligible for sharing. However proposed regulations published last June change this treatment. In prior years payments to Health Care Sharing Ministry Organizations have not been deductible as health insurance.

A health care sharing ministry HCSM is a health care cost sharing arrangement among persons of similar and sincerely administered by a not-for-profit religious organization. Some examples are Medi-Share Liberty HealthShare Christian Healthcare Ministries Altrua Health Share Shared Health Alliance and Samaritan Ministries. This year the IRS tax season officially starts on February 12 2021.

Except in Missouri monthly financial gifts to CHM are not tax-deductible. The Internal Revenue Service is set to recognize a health care sharing tax deduction for the first time. The proposed rule defines these fees or shares as payments for medical care or medical insurance which makes them eligible for a tax deduction as qualified medical expenses.

Your AHP is only going to be for more serious doctor visits. In these proposed regulations the IRS takes the position that payments for health care sharing ministry membership sometimes referred to as dues or fees qualify as health insurance and are deductible. Rather were the first and longest-serving health cost sharing ministry having shared over 6 billion in our members medical bills.

No except in Missouri where the amount is deductible from state income taxes. Section 213 of the Code allows individuals to take an itemized deduction for expenses for medical care including insurance for medical care to the extent the expenses exceed 75 of. Your normal monthly gift amount required for membership is not tax deductible.

Were not health insurance. Your CHM monthly gift and Brothers Keeper membership gift amounts are not tax deductible except in the state of Missouri. No they are not.

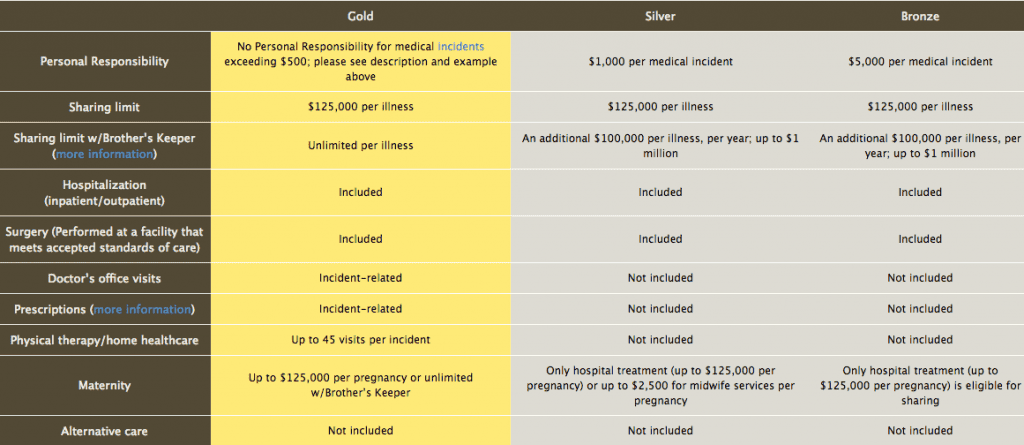

By the Christian Health Care Newsletter MINISTRY Christian Care Ministry Medi-Share Christian Healthcare Ministries Samaritan Ministries OTHER INFO Share Payment Tax-Deductible as Donation or Medical or Insurance Expense. Monthly gift amount is not tax. Are health care sharing ministries considered insurance.

Gifts processed in this system are not tax deductible but are predominately used to help meet the local financial requirements needed to receive national matching-grant funds. Christian Healthcare Ministries Inc.

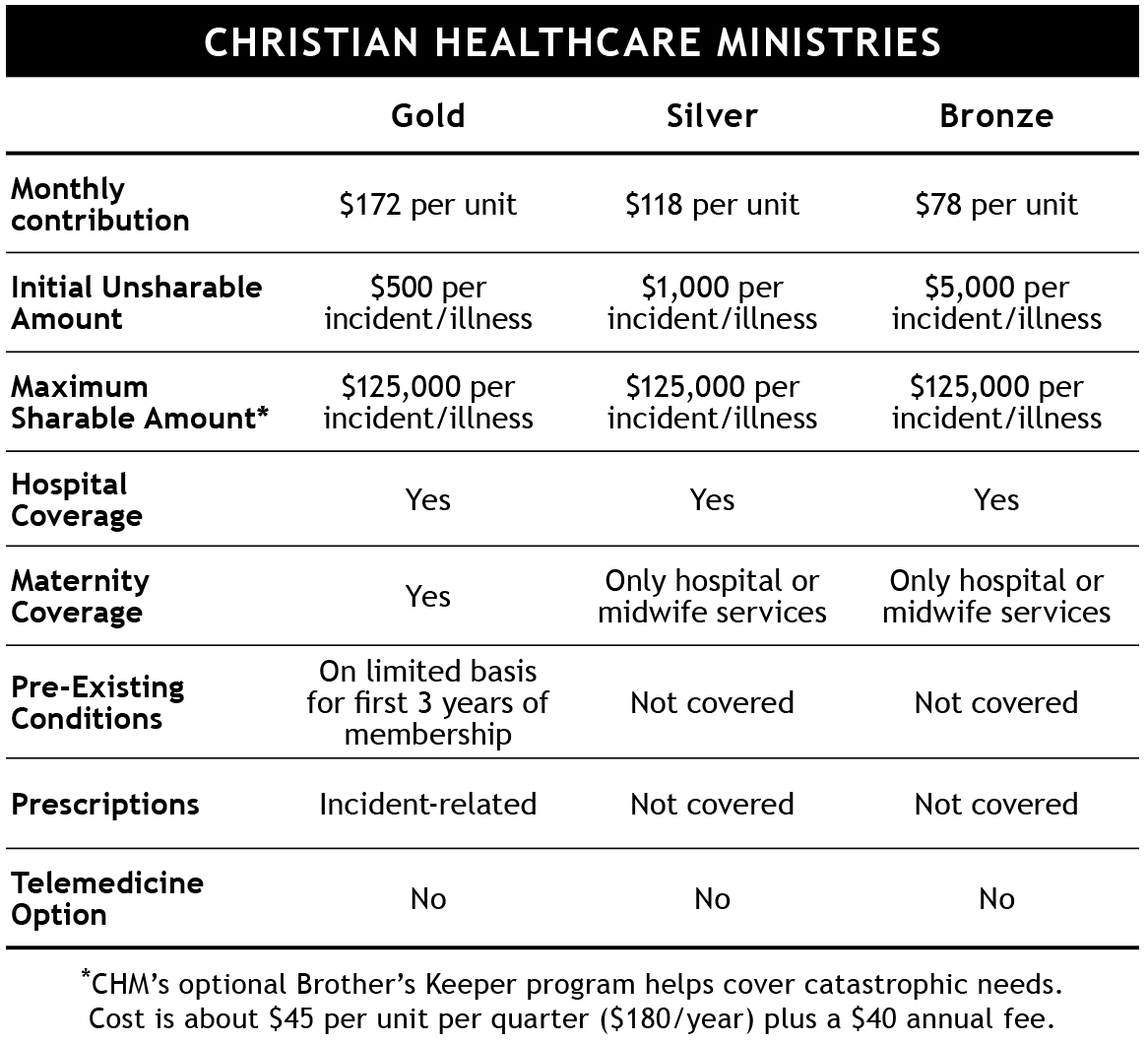

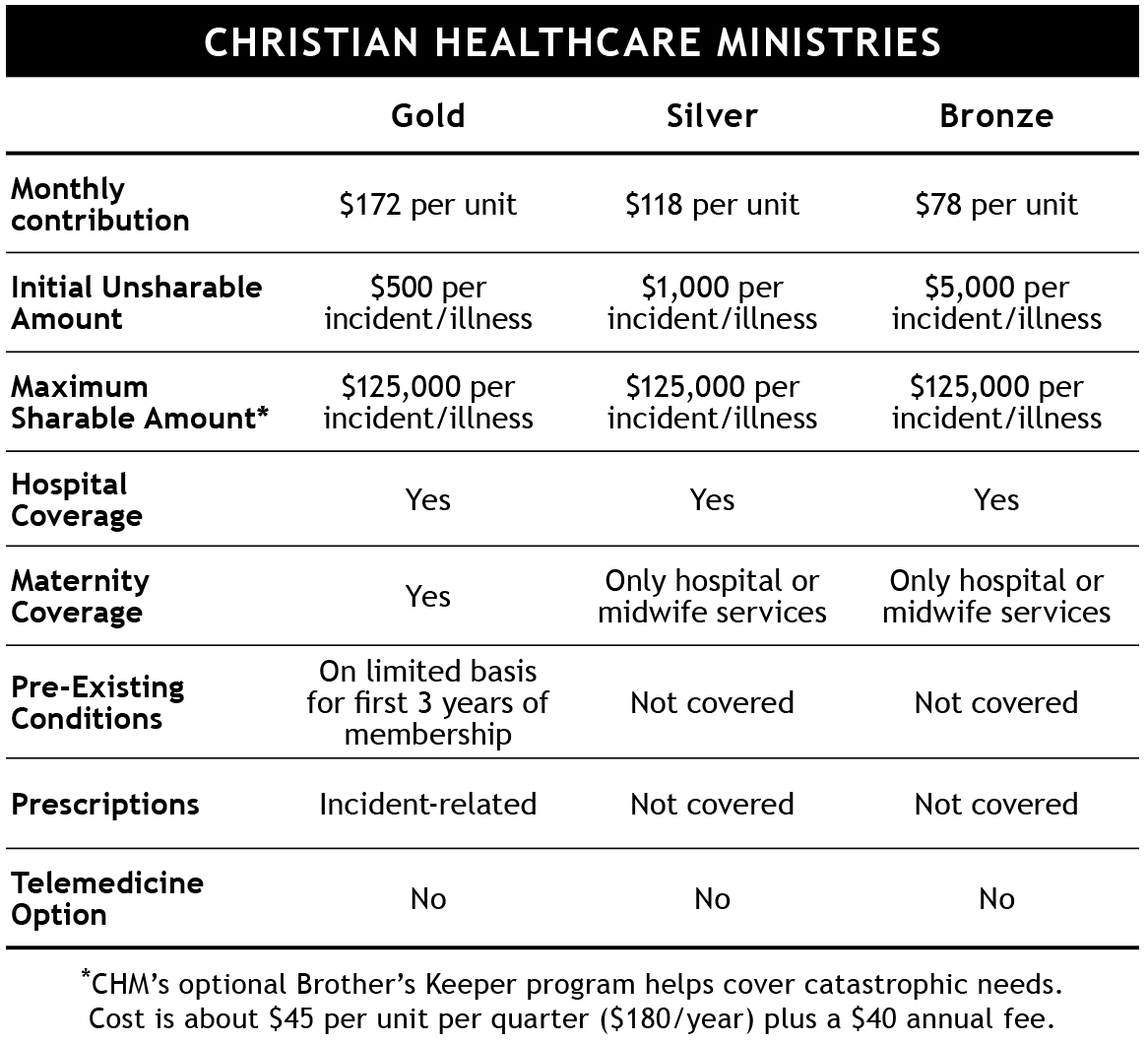

Christian Healthcare Ministries Vs Medi Share 8 Big Differences

Do I Need A Form 8965 For My Taxes With A Chm Health Cost Sharing Membership Christian Healthcare Ministries

Are Health Insurance Premiums Tax Deductible Insurance Deductible Medical Insurance Health Insurance

How To Save Big Money On Your Health Insurance Expenses Couple Money Individual Health Insurance Health Insurance Health Insurance Cost

Get Smart And Save Money With Christian Healthcare Ministries 2019 Dr Breathe Easy Finance Money Management Saving Money Health Care

Chm And Your Taxes What You Need To Know Christian Healthcare Ministries

Christian Healthcare Ministries Vs Medi Share 8 Big Differences

Ramadan Kareem Ramadan Kareem Ramadan How To Stay Healthy

Healthcare Alternatives To Health Insurance Christian Health Care Sharing Ministries

Is A Health Care Sharing Ministry Right For You Millennial Money Man Saving Money Millennial Money

2021 Christian Healthcare Ministries Review Our Experience With Surgery

Health Care Sharing Ministries A Christian Alternative To Health Insurance Sound Mind Investing

Cost Sharing Frequently Asked Questions Christian Healthcare Ministries

Tax Forms Resources Christian Healthcare Ministries

Our Two Year Review Of Christian Healthcare Ministries Our Next Rv Adventure

All About Chm Christian Healthcare Ministries

Https Www Christianhealthcareministries Review Com Wp Content Uploads 2016 05 Chm Guidelines 2016 V1 Pdf

Pin On Aryn S List Best Christian Books To Read

Christian Healthcare Ministries Vs Medi Share 8 Big Differences